surrender green card exit tax

However if you surrender your green card or the US. In the context of US personal tax law.

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Is there an exit tax upon surrendering the card 3.

. May be required to pay an exit tax on surrender of his or her green card. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. Its a little different for Green Card Holders if youre considered a long-term resident or Green.

A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other. Surrendering a Green Card US Tax Rules for LTRs. Citizen Immigration Service USCIS determines that you have abandoned your green card and takes it away from you you will need.

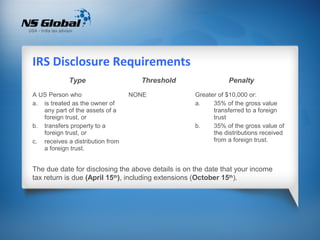

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Green card holders are subjected to the exit tax rules when they abandon their green card status by filing Form I-407 with the US. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed.

Nonresident Alien Income Tax Return. Surrender Green Card after 8 Years. Your income tax filing requirement and possible obligation to pay US.

This can mean that green card holders who. For purposes of computing the 8 year holding period having the green card for even one day during the calendar year will cause that entire year to be counted eg if the. Surrendering a Green Card US Tax Rules for LTRs.

What is the departure expatriation or exit tax for US Green Card holders. Once I surrender the green card do i have any US tax liabilities going forward 2. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. A longterm resident is defined as any individual.

For any period of time. An individual who is a long-term resident of the US. Surrender Green Card after 8 Years.

As a canadian citizen can i still collect my. The IRS Green Card Exit Tax 8 Years rules involving US. When a person is a covered expatriate it means they may be.

Paying exit tax ensures your taxes are settled when you. Government or when the US. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed distribution.

Your tax responsibilities as a green card holder do not change if you are absent from the US. Green card holders are also affected by the exit tax rules. Currently net capital gains can be taxed as high as.

The tax calculation assumes that you hypothetically sell all of your assets on the date before you gave up your GC its the same methodology if you renounce your citizenship and your tax rate.

Case Law On The Abandonment Of Permanent Resident Status Myattorneyusa

Overview Of U S Expatriation Cardinal Point Wealth Management

Abandoning Your Green Card The Implications Effisca

Tax Regulations In Usa Affecting Nri S 2013

Giving Up Your Us Green Card Americans Overseas

High Cost To Go Green Giving Up A Green Card

Re Entry Permits For Green Card Holders Explained

Income Taxes And Immigration Consequences Citizenpath

Renounce U S Here S How Irs Computes Exit Tax

Renouncing Us Citizenship Expat Tax Professionals

Giving Up Your Green Card Conductlaw

Reverse Immigration How Irs Taxes Giving Up Green Cards

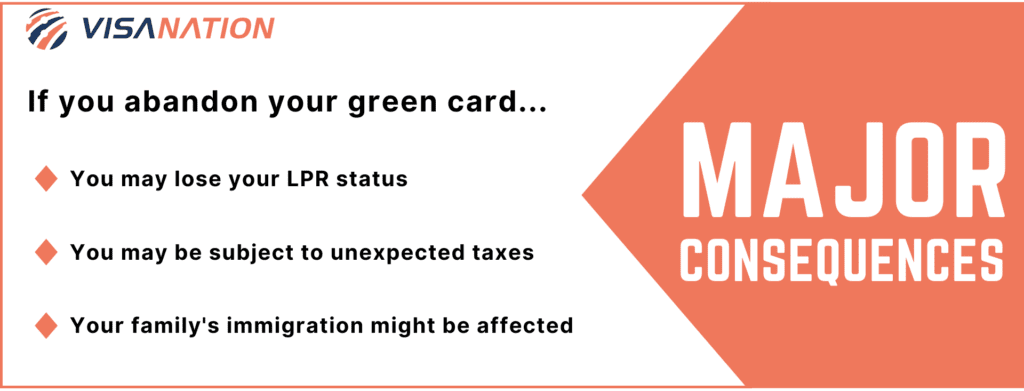

3 Green Card Abandonment Consequences Ways To Reinstate

Form I 407 How To Relinquish Your Green Card

What To Consider When Deciding To Renounce U S Citizenship For Tax Purposes The Globe And Mail

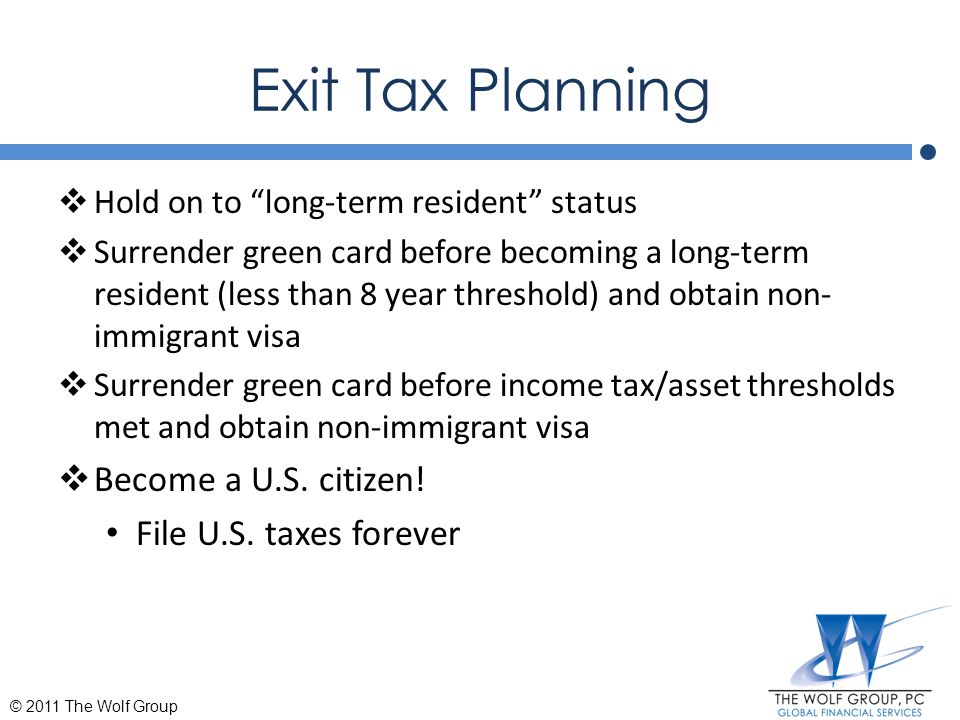

Exit Tax Planning To Avoid Minimize Expatriation Exit Tax Withum

5 Ways To Lose Permanent Resident Status Citizenpath